Medicare Supplement Plan N Review

Do you want to know my favorite thing about Medicare Supplement Plan N?

It’s not a Medicare Advantage plan.

In this article, I’ll cover the Plan N reviews that I’ve experienced as an agent since 2003. I’ve worked with thousands of clients on Plan N, Plan G, and Medicare Advantage.

I’m going to break down Plan N and give you some highlights regarding:

- Coverage benefits

- Cost

- Plan N vs. Plan G

- Plan N vs. Medicare Advantage

- Customer satisfaction reviews

- My final thoughts

Medicare Supplement Plan N Overview

Let’s jump in with an overview.

Plan N offers extensive coverage and the freedom to choose any network provider. Plan N is the second most popular Medigap plan, with over 1.5 million people enrolled.

Some of the key features of Plan N include:

- Consistent benefits year after year because Plan N is standardized – meaning that coverage is the same no matter which insurance company you choose to enroll with

- No network limitations or referrals

- Lower premiums compared to Plan G

- Offered by 95% of Medigap providers

- Your Plan N policy is guaranteed to remain in effect for life (as long as you pay your premiums on time)

Benefits of Medicare Supplement Plan N

Next up, I want to break down some of the common things that Original Medicare covers and then show you your shared cost. Let’s look at this Plan N benefit chart and then go through some of these points together.

So, first off, anything to do with your Medicare Part A cost, you have a $0 copay. That means that whatever your Original Medicare Part A deductible or copay or coinsurances, Plan N pays that for you. Your Medicare Part B is paid 100% after you pay a $240 annual deductible, and that’s for 2024.

For Part A hospice care, coinsurance, or copayment, you have a $0 copay. For skilled nursing facility care or coinsurance, $0 copay to you. It also provides an extra 365 days of hospital cost after using the Original Medicare lifetime reserve days.

Here are some out-of-pocket costs that come with Plan N (note that these do not come with Plan G):

- For the emergency room, you’re going to have a $50 copay.

- For office visits, you’re going to have a $25 copay.

- Hospitalization and skilled nursing (we’ve already kind of covered that) is a $0 copay.

- Skilled nursing facility is a $0 copay for coinsurance for up to 100 days.

- You also have a foreign travel emergency care. Beneficiaries receive 80% of coverage for emergency care outside of the United States or its territories.

- Plan N has a lifetime maximum of $50,000 for foreign travel emergency care after a $250 deductible has been satisfied.

Now, let’s jump in and talk about what’s on everyone’s mind – monthly premiums.

How Much Does Plan N Cost?

In 2024, the average monthly cost for Plan N will be between $105 and $175. However, the monthly premium for Plan N can vary depending on location, gender, and tobacco use.

I recommend considering these factors and comparing rates so you can find the most affordable and suitable Plan N coverage for your needs and budget.

This chart gives you an idea of Plan N premiums from various Medigap providers in several states:

| Medigap Provider | Alabama | Georgia | Texas | Florida | Pennsylvania |

| Cigna | $105.15 | $119.58 | $98.50 | $141.29 | $91.92 |

| ACE | $97.75 | $107.67 | $85.42 | $149.25 | $90.75 |

| Mutual of Omaha | $120.56 | $129.49 | $120.50 | $147.95 | $104.60 |

| Aflac | $112.94 | $119.21 | $99.41 | $150.52 | $99.94 |

| Allstate | $119.52 | $106.80 | $92.75 | $167.31 | $92.64 |

| Aetna | $105.29 | $113.20 | $116.54 | $172.35 | $103.71 |

| Plan N sample quotes are for a 65 y/o nonsmoking male. |

|||||

What Does Plan N Not Cover?

As previously mentioned, Plan N does not cover your Part B deductible, which again in 2024 is $240 per calendar year, and it does not cover Part B excess charges – whereas Plan G does.

Plan N does not cover pharmacy or RX benefits like all Medicare Supplement plans. You would be required to pick up a secondary prescription drug plan.

Plan N vs. Plan G

How does Plan N compare to Plan G?

Medigap Plan G offers coverage for Part B excess charges, while Plan N does not. Plan N requires you to pay copays or coinsurance for certain services, such as doctors and emergency rooms, while Plan G covers 100% of these areas.

-

Excess Charges

Okay, let me give you another scenario on the excess charges.

- Let’s say you go to a provider. They can bill up to 15% over the Original Medicare amount. Plan G will pay for that. Plan N will not.

- Plan N will have copays for doctor visits and emergency rooms – which to me is not that big of a deal because when you opt for Plan N, having those copays actually makes your monthly premium just a little bit less.

It’s imperative to compare the cost of Plan N next to Plan G just to ensure that the savings on Plan N are enough to take on those copays.

If the two are so close in price, you might as well pay a little bit higher monthly premium to have Plan G pay those office visits and emergency room copays for you because, again, when we run the numbers for clients, there’s just not a big disparity between the two.

So I would say opt for Plan G – leave the confusion and the claims process out with the copays on the office visits and ER.

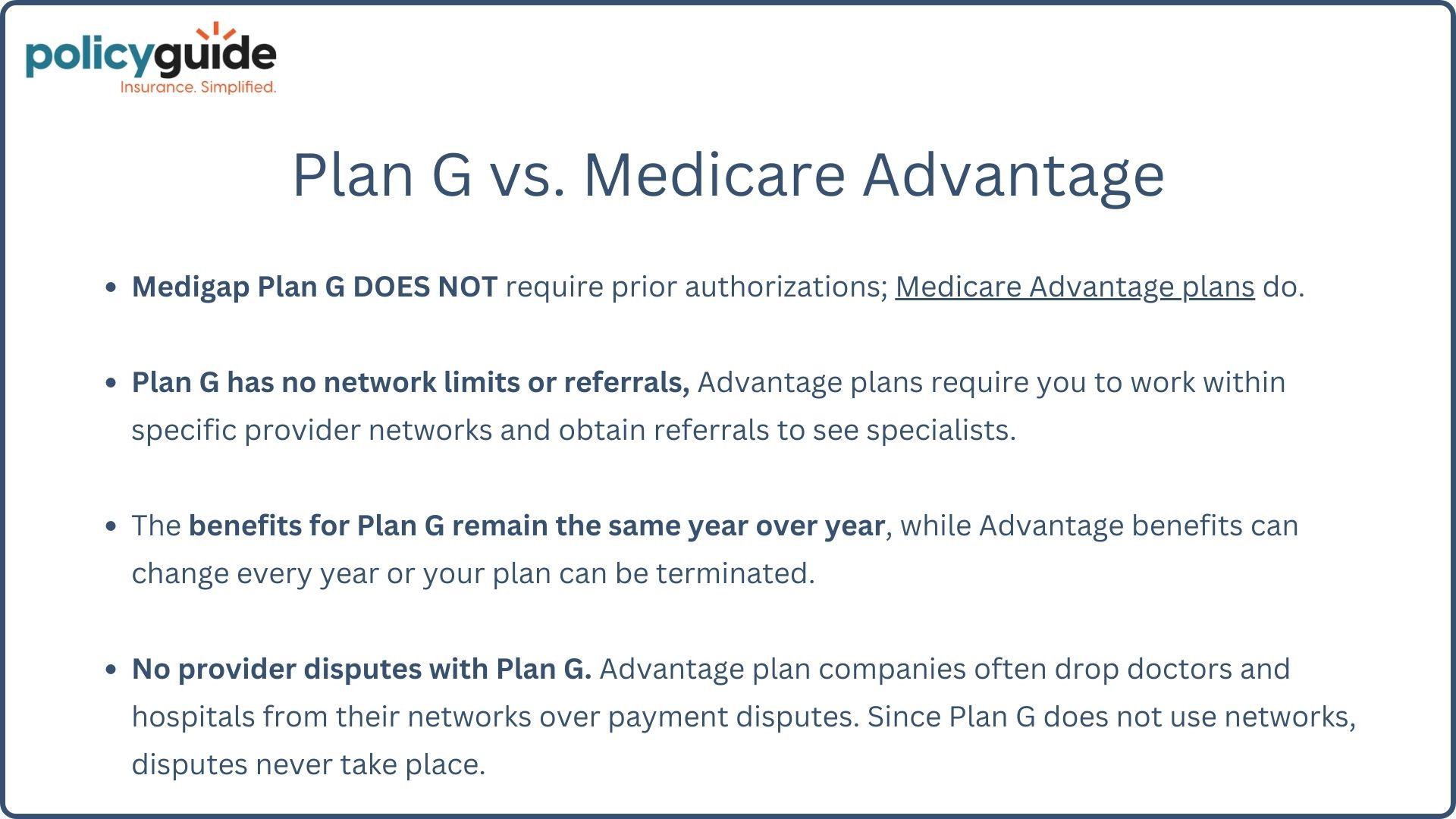

Plan N vs. Medicare Advantage

Now, probably the most important part of this article is this section—Medigap Plan N vs. a Medicare Advantage plan. I’m going to break down the core differences.

Hear me loud and clear: the biggest thing is that Plan N does not have prior authorizations. Here’s a scenario, as you’ve seen in some of my other articles and videos:

Let’s say you go in for chest pain.

They’re going to run you through all kinds of tests and procedures to figure out what’s happening.

With Medicare Advantage, those tests may require the insurance company to require prior authorization.

That means before we can proceed with this test, the insurance company has to authorize the procedure before they can do it.

So, on a Medicare Advantage plan, you could be waiting minutes, hours, or days for that prior authorization to go through. And when it’s a life-threatening issue, you don’t have minutes, hours, or days to spare.

With Medigap, there are no prior authorizations. You go in, and they’ll treat you immediately with whatever is necessary.

Again, I cannot emphasize this enough. No matter your Medigap plan, you’re not dealing with prior authorizations. However, regardless of your Medicare Advantage plan, you will deal with prior authorizations.

Another difference between the two plans, as I mentioned before, is that we are dealing with no referrals on Plan N. No networks, HMOs, PPOs, or calling providers. As long as the providers you see anywhere in the country take Original Medicare, they will take Medigap Plan N.

If you have an HMO that’s Medicare Advantage, you’ll deal with referrals. You’ll have a gatekeeper. You will have networks to deal with and work within, whether it be an HMO or PPO. Those both use networks, so that can change.

Another important difference is that with a Medigap plan – there are no benefit changes. So, on Medicare Advantage, you will see copays, premiums, coinsurance, and deductibles change each year. They most likely go up. On Plan N, whatever your benefits are, they’re locked in for life. They do not change as long as you pay that premium.

Last on the list are no CMS disputes. What is this?

- Medicare Advantage companies are actually paid by CMS or the federal government per every member they enroll. Well, that reimbursement rate can go up, and it’s very favorable to the insurance company. And then the next year, it can go down where it’s a disadvantage to the Medicare Advantage company. That’s when they may adjust your premium or benefits when they’re not getting enough from the federal government.

That reimbursement mechanism does not exist with Plan N or any Medigap plan. Original Medicare pays its part, and then you have your Medigap Plan N with its premium, and it pays its part. There’s no middle reimbursing or negotiating between the two.

Hospitals usually dispute insurance companies over reimbursement rates. It’s very common (if you just look at a lot of the news headlines) for a big provider group to dispute an insurance company. Sometimes, it results in them terminating the contract.

If you have that Medicare Advantage plan and that is your hospital, you’re now out of network.

Customer Reviews

One of the last points here is some of the strong reviews on Plan N. As I mentioned earlier, Medicare Plan N is the second-most popular Medigap plan, just behind Plan G.

A study by AHIP revealed that people are highly satisfied with their Medicare Supplement coverage. So, this isn’t a Plan N study. This is more of a general Medigap (Medicare Supplement) study.

But I found it quite fascinating when you look at the findings:

- 93% of beneficiaries were satisfied with their supplement plan.

- 83% rate their supplement coverages as excellent or good.

- 96% of beneficiaries agree that Medigap coverage allows them to see trusted doctors and specialists without worrying about out-of-pocket costs.

- Lastly, 77% of beneficiaries find the most valuable benefit to be coverage of hospital expenses, which makes perfect sense because that’s where most of the cost is incurred.

Final Thoughts

My final thoughts are this: I strongly advocate for Medicare Supplement plans.

If you can afford a Medicare Supplement, I would strongly advise you to do that for the comprehensive coverage, no network, no disputes with CMS, no referrals, and no reimbursement rates. You set it and forget it.

The only thing you need to keep track of over the years on a Medicare Supplement plan is to monitor your rate because, just like every other type of insurance (homeowners, auto, you name it), unfortunately, insurance rates don’t go down; they go up – but they’re moderate in the Medicare Supplement world. .

But that’s really the only moving part with a Medigap plan.

One of the things we do at Policy Guide is conduct annual rate checks to ensure people are still paying an affordable premium. If not, we’ll try to change companies for them and keep them on a Medicare Supplement plan.

For many reasons, Medigap Plan N is my second favorite. Plan G is my favorite because there is a little bit of additional cost and even less for you to worry about.

I hope this was informative. If there’s anything we could do to help, we’d be happy to—feel free to give us a call or email us.

Sources: AHIP Trends | AHIP Study